I haven't received my P60 yet - What do I do?

Once the extravagance of Christmas is over, it’s back to tightening our belts. We mark the days off on the calendar to the next pay day and scramble around the back of the press to see what dinner we can make out of a packet of noodles, a tin of sweetcorn and an onion.

This is the time of year where we all get sense and start looking at our finances- needs must as they say! It’s a time of year that we associate with waiting anxiously for our P60 from our employer and praying to the gods of revenue that we may be due some tax back for the previous year. But it is now March and you are still waiting.

However, the wait is no more. Revenue have implemented what they call “PAYE Modernisation” since January 2019. This means that every time your employer makes a wage payment to you, that data is sent electronically to revenue in real time. For the employee, it means that revenue are no longer reliant on receiving an P45 or a P60 in order to know what income you have earned or what tax you have paid. These documents are now a thing of the past. So, your employer has not reneged on their duties with regard to your P60..

But I hear you ask- “what if I need a statement of my earnings for 2019 for a mortgage or loan application”? The answer is, you can simply now download an “Employment Detail Summary” from revenue, which contains your income and deduction details for the year, as reported to Revenue by your employer.

In order to do this, you need to login to Revenue’s “My Account”.

Please see the following information video from revenue on how to access your pay and tax details on MyAccount.

To access your “Employment Detail Summary”

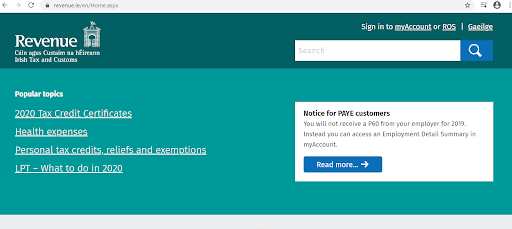

- Go to www.revenue.ie and click on “myAccount”.

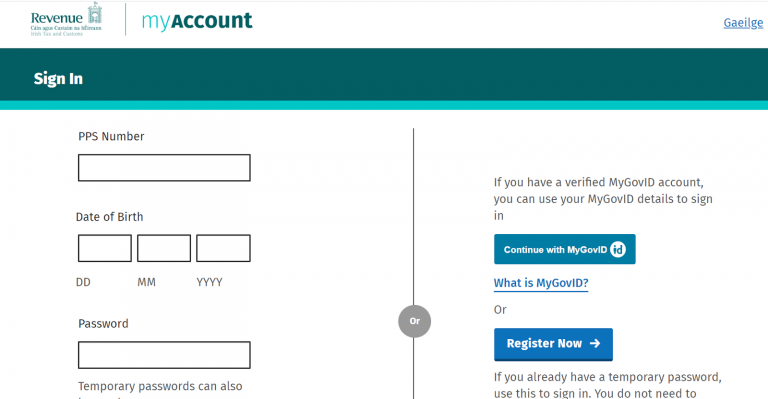

You will be asked for your PPSN, DOB, Your “MyAccount” OR “MyGOVID” password.

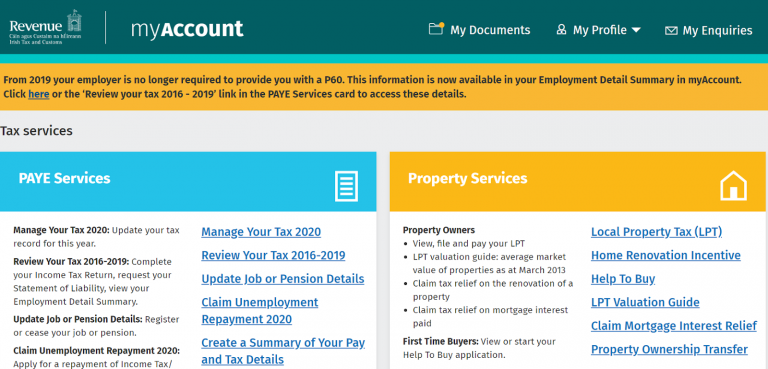

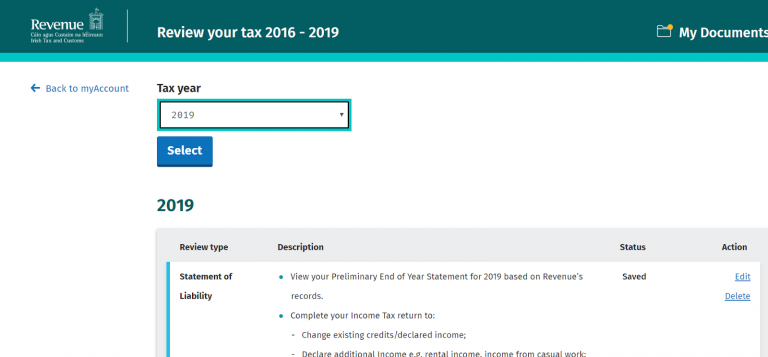

- Then click on “Review your Tax 2016-2019

You then select the requied year from the dropdown field.

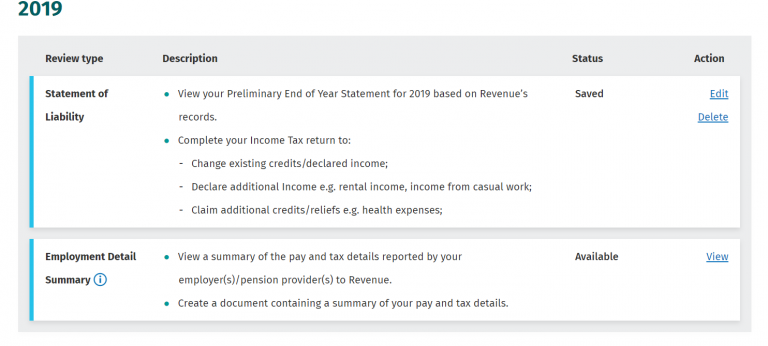

- Further down on the same screen under “Employee Detail Statement” Click “View”

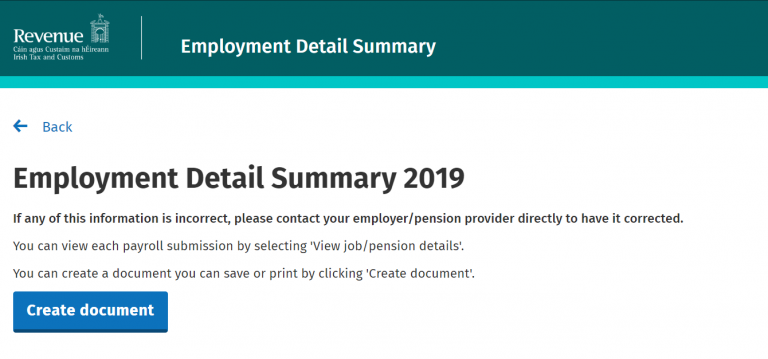

- Then Click on “Create Document”. On this same screen you will see a summary of your (and your spouses if applicable) pay and tax details.

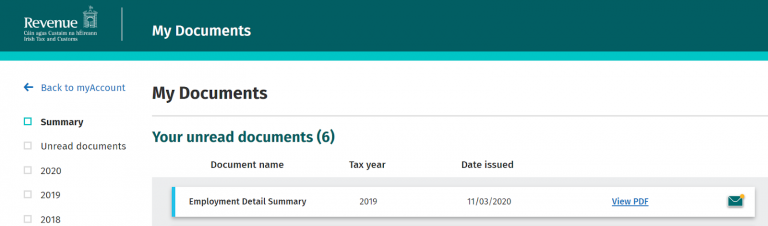

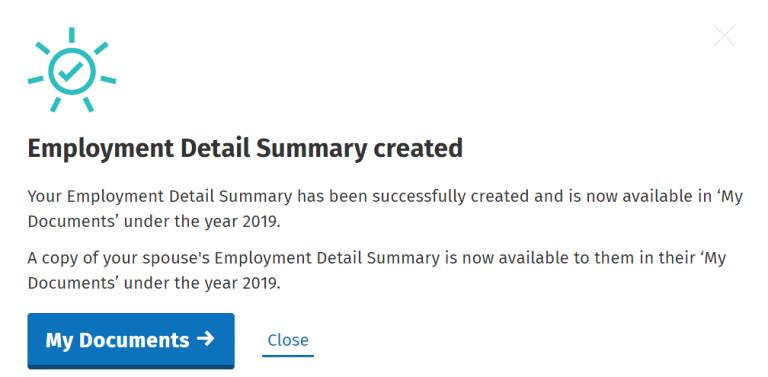

- The following message will appear. Click on “My Documents”

- And finally you can view and print off your pdf